When it comes to adulthood, paying bills is a rite of passage that nobody enjoys. It’s a tedious task that, on top of being time consuming, is also a high stakes game. If you miss a due date, bounce a check, or underpay someone, it can affect your credit score, and in the case of subscriptions suspend a much-needed service. Not to mention how important (and difficult) it is to maintain a holistic picture of your ongoing expenses.

Here are three exciting startups making it easy for anyone to streamline and automate their bill payment processes.

OnePay

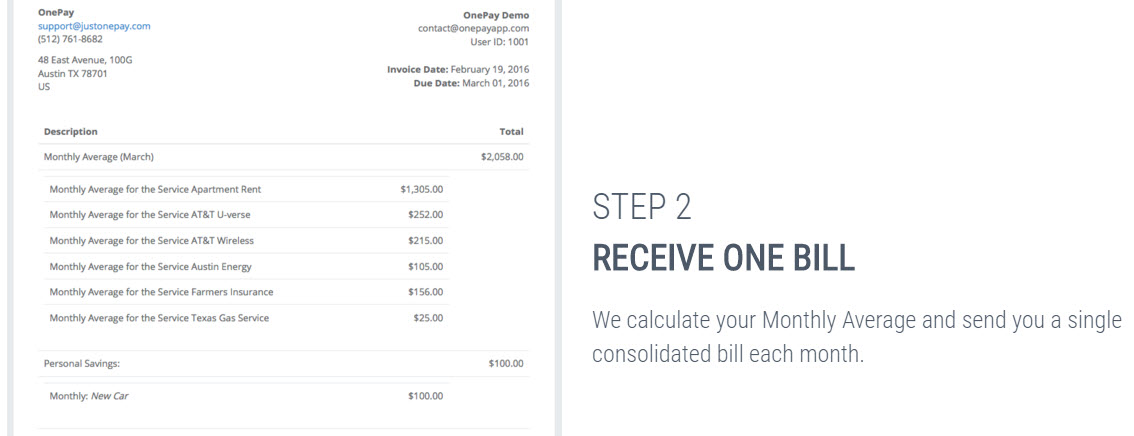

Have you ever wanted to just roll all your bills into a single payment once a month? If so, you’ll love OnePay. As the name implies OnePay streamlines your bill payment processes and is best described as a payment consolidator. Users simply create an account, enter their payment information and OnePay handles the rest.

What sets OnePay apart from the competition is their built-in deal shopping. Once connected to a user’s account, the service shops around and looks for better prices on services based on your zip code.

The startup is currently backed by the Longhorn Startup Incubator and Tech Ranch Incubator.

Prism

Although being able to pay your bills in one shot is useful, there are still times when users need to access essential financial information from a single portal. Prism, founded back in 2011, has been looking to overcome one of the biggest limitations of banks; the inability to access account details from third-party providers.

The core of the Prism offering is an all-in-one dashboard where users can view upcoming bills, account balances, transactions, and other essential information. Users simply download the app to their smartphone or tablet. After selecting all the payees, Prism syncs the account details, bills, and other essential information in real-time.

Prism is currently free to use and there are versions for Windows 8, the Kindle Fire, Android, and iOS devices.

Bobby (formerly Billy)

Just like apps on a phone, it’s easy to subscribe to dozens of paid online services (video streaming, cloud services, data providers, etc.) and eventually forget about them as time goes on. Bobby is a simple mobile app in which users enter their subscriptions and receive alerts when the balances are due and allow them to quickly see all their monthly balances in one clean list.

Unlike the other services here, there is currently no integrated payment gateway. According to a press release, Jeffrey de Groot created the app to help him simplify his expense tracking shortly after moving out of his parents’ home.

The free version of Bobby supports up to four subscriptions, however that cap can be lifted for a relatively low fee of approximately $1.44.

————-

Feature image courtesy of blog.credit.com