Managing money and saving money is something we all have to deal with, but with conflicting advice, stuff you really really want to buy and so many other things to worry about in life, they can be difficult tasks – not to mention the fact that one wrong move can send you spiraling into debt. Fortunately, there are plenty of startups and apps out there to lend a hand. Here are four of the best ones.

Qapital

Founded in 2012, Qapital is designed to help millennials curb both their bad spending habits and their irregular saving habits simultaneously. Founded in 2012 by Swedish ex-bankers, the app aims to take your everyday life and activities and turn it into a reward system by setting up “Rules.” You ran two miles today? Put some money away for your vacation.

However, if you’re the type of person to waste money at Starbucks everyday, try ending the habit by making a deposit into Qapital whenever you buy a latte. Or, if you really can’t go without your coffee, just set a limit on how much you want to spend at a certain place, and if you’re under your cap, the difference is deposited into your accounts. Additionally, you can set up a rule that rounds up the change every time you make a purchase and that difference (pennies ad up!) is set aside and deposited. Qapital’s rules make saving into a game, and since it has full IFTTT functionality the possibilities are endless.

Qapital has raised $5.3 million in funding so far.

Digit

Digit, to me, is the most interesting out of the five because it’s sneaky-helpful. After signing up with Digit and linking it to your checking account, the system will track your usual expenses and take out small amounts of money every few days when it sees that you can spare a few bucks. The money it takes out is stored in a Digit savings account for you, from which you can withdraw at any time. Other than a few texts updating you on your account, Digit mainly works in the background of your life – you may not even notice it’s there until you decide to take out the money and fly off on a vacation.

Acorns

Investing money is tricky, especially for twenty-somethings who are trying to get their feet off the ground financially. Acorns offers an option. Simply by connecting your credit and debit cards, Acorns like Qapital, will track your purchases and round them up to the nearest dollar – but instead of putting the difference in a static checking or savings account, it adds the money to an investment portfolio that is monitored by experts. You can choose from five different portfolio risk options (from conservative to aggressive), and change it on the fly as you see fit. You can also make deposits and withdrawals manually if need be.

Users pay a $1 monthly fee for accounts under $5,000 and .25 percent a year for accounts over $5,000, though students are able to invest for free.

Acorns was founded in 2012 and has raised $31.96 million from investors.

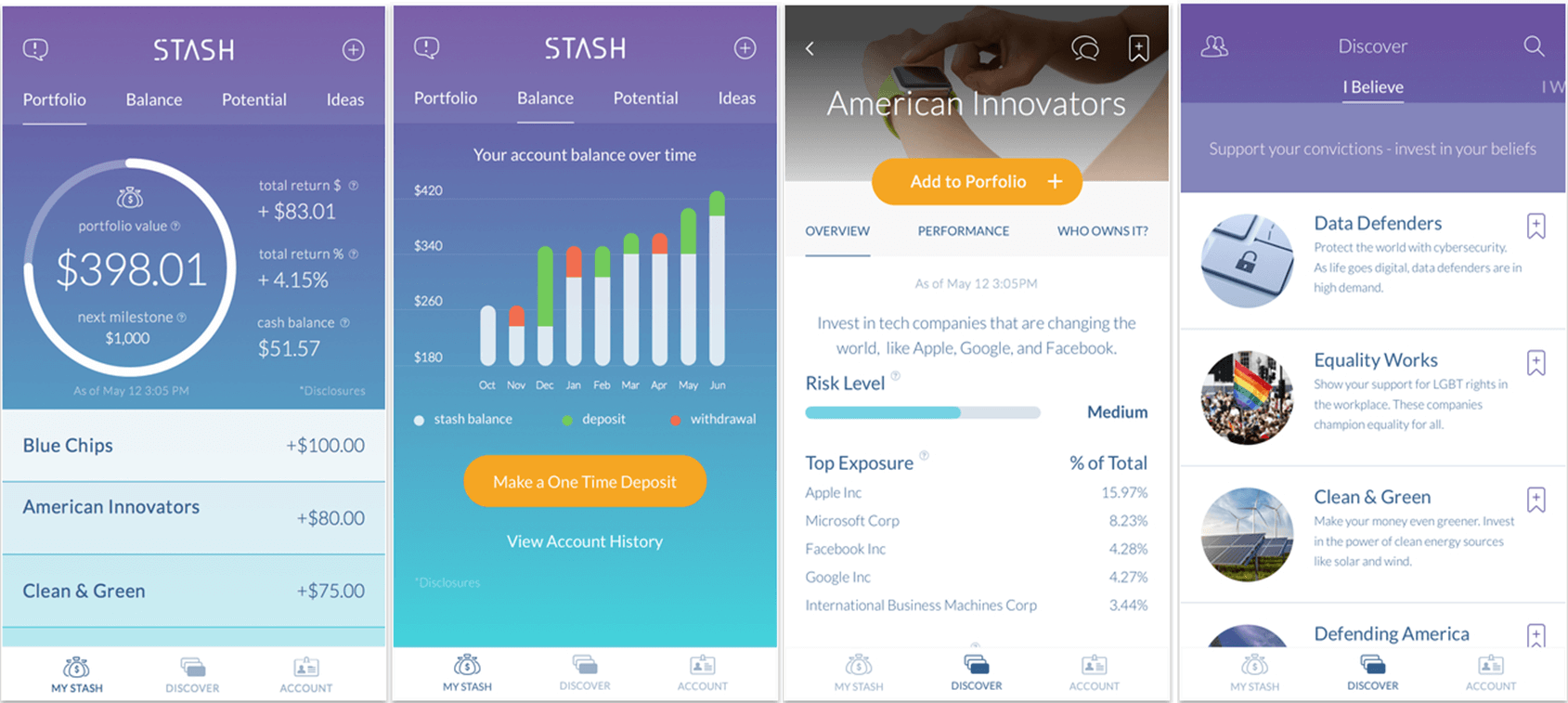

Stash

Stash is similar to Acorns in that it allows you to invest a small amount of money at a time, but Stash is much more focused on the user’s interests, beliefs and goals, allowing you to choose the types of areas, companies and causes in which you want to you invest your money. Founded almost exactly a year ago, it’s the newest startup on the list, and has raised $4.5 million in funding. Users can start investing with as little as $5, and the app will set up milestones to help build good investing habits. Stash is free for the first three months, then, like Acorns, it charges $1 per month for accounts under $5,000 and .25 percent a year for accounts over.